The CA Quarterly Review (Summer 2024)

NEWS & INFORMATION QUARTERLY FOR OWNERS & AGENTS OF THE PERFORMANCE BASED CONTRACT ADMINistrator FOR NORTHERN CALIFORNIA

- Happy Summer!

-

- Coming Soon: TRACS 203A Update

-

As the long days of Summer approach, the Multifamily Housing Community is patiently awaiting the TRACS update. While HUD has not published any new updates to the timetable for the release of TRACS 203A, the deadline for MFH Owners to be in full HOTMA Compliance is January 1, 2025. Here is a reminder of what the update will entail:

The current TRACS Version 202D, is being upgraded to 203A in order for HUD to accept data from Multifamily Housing (MFH) business partners that complies with updated policies and procedures. This upgrade will also encompass all requirements and changes under the Housing Opportunity Through Modernization Act of 2016 (HOTMA) Final Rule published in the Federal Register on February 14, 2023 Federal Register Volume 88, Issue 30.

TRACS Version 203A Rollout—

TRACS 203A MAT User Guide – Specifications and Edits to the MAT Guide:

- When completed, will be posted to TRACS Documents page: Multifamily Housing - TRACS Documents - HUD.

- OMB has to approve all Voucher forms (50059, 50059-A, 52670, and Special Claim forms).

203A Testing – TRACS Database made available for both CA and OA software testing.

- Test phases will be rolled out in Sprints to encompass all 203A changes and HOTMA requirements.

203A Go Live Transition

- Go Live date is tentative as it is dependent on OMB forms approval.

- TRACS and CA software begins accepting both 202D and 203A Voucher and Certification transmissions.

- OA transition period will be determined and announced later.

- All certifications entered after 203A is fully up and running must follow HOTMA rules

- HOTMA Highlights

-

Full compliance with the HOTMA final rule is mandatory effective January 1, 2025. HUD provided a wealth of information in Notice H 2023-10 to help MFH Owners prepare and subsequently implement the many program changes brought about by the Housing Opportunity Through Modernization Act of 2016 (HOTMA) sections 102 and 104 and detailed in the Final Rule published in the Federal Register on February 14, 2023.

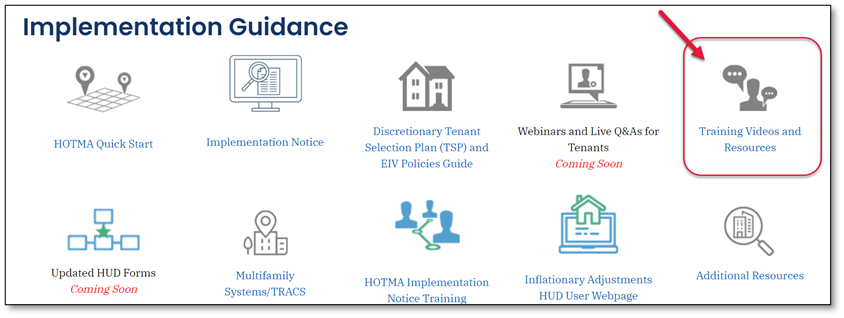

New HUD Resources

Most recently, HUD has released training videos covering the below topics which are posted on HUD’s Multifamily HOTMA Website:

- Implementation Overview

- Net Family Assets

- Determining Income

- Mandatory Deductions & Hardships

- Annual Reexaminations

- Verifications & Other Related Topics

- Interim Reexaminations

- Asset Limitation

These training videos can be accessed under the Implementation Guidance section on the website.

Review of HOTMA Changes (from Notice H 2023-10)

Asset Limitation – HOTMA will create a restriction on the eligibility of a family to receive assistance if the family owns real property that is suitable for occupancy by the family as a residence or has assets in excess of $100,000. Owners are given discretion at reexamination in enforcing the asset limitation on eligibility for assistance.

Calculating Income – New Admissions and Interim Reexaminations will remain consistent with the pre-HOTMA process. For Annual Reexaminations, Owners must first determine the family’s income for the previous 12-month period and use this amount as the family income for annual reexaminations; however, adjustments to reflect current income must be made.

- Owners will not be considered out of compliance solely due to de minimis errors in calculating family income. De minimis errors occur when an Owner’s determination of a family’s income deviates from the correct income determination by no more than $30 per month in monthly adjusted income (or $360 in annual adjusted income). While Owners will not be issued a finding for de minimis errors in income calculation, they are obligated to correct the error(s) retroactive to the effective date of the action the error was made regardless of the dollar amount associated with the error.

Deductions and Expenses –

- The elderly/disabled family deduction will increase from $400 to $525.

- The sum of unreimbursed health and medical care and reasonable attendant care and auxiliary expenses will change to what exceeds 10 percent of the family’s annual income can be deducted from annual income.

- Concurrently with this increase, the regulations provide financial hardship exemptions for unreimbursed health and medical care expenses, and for reasonable attendant care and auxiliary apparatus expenses for eligible families. A family will benefit from this hardship exemption only if the family has eligible expenses that can be deducted in excess of 5 percent of annual income.

Income – Imputed returns on net family assets are included in annual income only when net family assets exceed $50,000 (a figure that is annually adjusted for inflation) and actual asset income cannot be calculated for all assets. Imputed income from assets is no longer determined based on the greater of actual or imputed income from the assets. Instead, imputed asset income must be calculated for specific assets when three conditions are met:

- The value of net family assets exceeds $50,000 (as adjusted for inflation);

- The specific asset is included in net family assets; and

- Actual asset income cannot be calculated for the specific asset.

Income Exclusions – HUD is clarifying and adding some exclusions when it comes to a family’s Net Family Assets. One example is the nonrecurring income exclusion which replaces the former exclusion for temporary, nonrecurring, and sporadic income (including gifts), but it provides a narrower definition of excluded income.

Inflationary Adjustments – HUD will annually publish the eight inflation-adjusted items in the table below no later than September 1, and the updated values will be shared online at the HUDUser Web site. The revised amounts will be effective on January 1 of the following year. The first set of adjustments for inflation will be made effective January 1, 2025.

Interim Reexaminations – The final rule changes the conditions under which interim reexaminations must be conducted, codifies when interim reexaminations should be processed and made effective, and requires related changes for annual reexaminations and streamlined income determinations. When the Owner determines that an interim reexamination of income is necessary, they must ask the family to report changes in all aspects of adjusted income. Owners must conduct an interim reexamination of family income when they become aware that a family’s annual adjusted income has changed by an amount that the Owner estimates will result in a decrease of 10 percent or more in annual adjusted income or a lower threshold set by HUD or the Owner in their TSP. Owners must also conduct an interim reexamination of family income when the Owner becomes aware that the family’s adjusted income has changed by an amount that the Owner estimates will result in an increase of 10 percent or more in annual adjusted income or another amount established through a HUD notice, with the following exceptions:

- PHAs/MFH Owners may not consider any increases in earned income when estimating or calculating whether the family’s adjusted income has increased, unless the family has previously received an interim reduction during the same reexamination cycle; and

- PHAs/MFH Owners may choose not to conduct an interim reexamination during the last three months of a certification period if a family reports an increase in income within three months of the next annual reexamination effective date.

Verification – The final rule updated verification of income requirements. All applicants must sign the consent form at admission, and participants must sign the consent form no later than their next interim or regularly scheduled income reexamination. After an applicant or participant has signed and submitted a consent form either on or after January 1, 2024, they do not need to sign and submit subsequent consent forms at the next interim or regularly scheduled income examination except under the following circumstances:

- When any person 18 years or older becomes a member of the family;

- When a member of the family turns 18 years of age; and

- As required by HUD or the PHA in administrative instructions.

The regulation clarifies that Owners must use EIV to verify tenant employment and income information at annual and streamlined reexaminations of family composition and income. However, Owners are no longer required to use EIV to verify tenant employment and income information during an interim reexamination of family composition and income. Lastly, HUD is adjusting what the Department considers acceptable documentation of SSN to make it easier for applicants to access programs even if they do not have access to their Social Security card or other documentation acceptable to HUD. Owners must still attempt to gather third-party verification of SSN prior to admission; however, they will also have the option of accepting a self-certification and a third-party document with the applicant’s name printed on it to satisfy the SSN disclosure requirement if the PHA/MFH has exhausted all other attempts to obtain the required documentation.

-

- HUD 2024 Income Limits

-

HUD published the 2024 income limits effective 4/01/2024. Owner/Agents must ensure that they utilize these income limits for files with certifications dated 4/01/2024 and after.

- Click here to see new limits

-

- NOW REQUIRED: Revised Tenant Selection Plans (TSP) and Enterprise Income Verification (EIV) Policies and Procedures

-

Per HUD Notice H 2024-04, the compliance date for updated TSP and EIV Policies and Procedures was May 31, 2024. At this point, MFH Owners must have their updated TSP and EIV Policies and Procedures available to the public. The updates must reflect the guidance in Notice H 2023-10 and reflect all HOTMA rules and discretionary policies.

- NSPIRE Rollout Readiness

-

Beginning October 1, 2024, HUD will begin implementing the National Standards for the Inspection of Real Estate (NSPIRE) in accordance with the Final Rule published May 10, 2023. Developed with input from owners, tenants, PHAs, technical experts, and members of the public, the Final Rule updates HUD’s 20+ year old physical inspection model and better ensures residents have safe and decent housing.

While a seamless transition from Housing Quality Standards (HQS) inspections to NSPIRE inspections is anticipated, there are some key differences to note to be fully prepared for the NSPIRE inspections roll-out this Fall. This article will cover similarities between HQS and NSPIRE, and the differences that have the potential to affect owners and landlords with inspections beginning October 1.

NSPIRE removes the emphasis on condition and appearance defects and inspectable areas outside residential units, instead focusing on functional defects and areas that impact the health and safety of residents. The inspection process itself is more detailed, walking the inspector through what they should look for and what qualifies as a deficiency, allowing for less inspector discretion.

The types of inspections – annual, initial, special, etc. – will remain the same and there will not be a requirement for self-inspections. Additionally, the timing of inspections, enforcement of Housing Assistance Payments (HAP) contracts, enforcement of family obligations, and who conducts the inspections will not change. All inspections will remain pass/fail.

Inspectable areas will be defined as Unit (the area occupied by the resident), Inside (common-use areas within the apartment building), and Outside (areas outside the building). These are areas already subject to inspection under HQS, as recorded in sections such as ‘common halls and stairways’ and ‘building exterior’. The site and neighborhood requirements, such as excessive noise, air pollution, etc., are no longer a requirement with NSPIRE and will not be inspected.

Health and Safety (H&S) deficiencies are divided into three categories under NSPIRE – life-threatening (severe), moderate, and low. The life-threatening category requires a repair timeframe of 24 hours. The HOTMA life-threatening list is mandatory. Deficiencies that fall into the moderate category must be repaired within 30 days. Repair deadline extensions for items in the moderate category may be granted by the PHA provided there is a valid reason for the requested extension. Any issues that do not meet the criteria to fall in to either the severe or moderate categories, but if left unaddressed may deteriorate to either of those levels, will be recorded in the low category. Deficiencies seen in this category will not have a required repair timeframe, like the ‘pass with comment’ seen in previous inspections. This allows for information sharing regarding areas that require a small amount of maintenance to prevent development into a moderate or severe deficiency at future inspections.

Congressional changes to smoke and carbon monoxide alarm requirements are implemented into NSPIRE and missing, damaged, covered, or non-functioning alarms will be recorded as a life-threatening deficiency requiring repair within 24 hours.

A smoke alarm is required in each bedroom and sleeping area, in the immediate area outside of each bedroom, and one on each level of the residence (including a basement). A smoke alarm installed in the residential unit’s hallway, in the immediate area of the bedrooms, will satisfy the requirement for the smoke alarm on that level of the home and depending on the proximity of this alarm to the living room (classified as a sleeping area), could satisfy the requirement for a smoke alarm in this sleeping area as well. Residential buildings are required to have a smoke alarm on each level of the building. This is separate from the alarms installed inside of each residential unit of the building. Effective December 2024 smoke alarms will be required to either be hard-wired or have a sealed 10-year battery. At that time, battery operated alarms that are not the sealed 10-year battery type will be recorded as a life-threatening deficiency.

For those residential units with a fuel-burning appliance or fuel-burning fireplace, a carbon monoxide alarm is required in the residential unit within the immediate vicinity of each bedroom or within each bedroom. Should a bedroom, a bathroom attached to the bedroom, or an adjacent space to the bedroom have a fuel-burning appliance or fuel-burning fireplace, a carbon monoxide alarm is required within the bedroom. If the residential unit is served by a forced-air furnace located elsewhere, a carbon monoxide alarm will be required either inside the bedroom, or within the immediate vicinity of each bedroom, or in the room with the first duct register. Residential units that are one story or less above or below an attached private garage are required to have a carbon monoxide alarm within the immediate vicinity of each bedroom or within each bedroom.

The permanent heat source for residential units must be in working condition between October 1 and March 31 and provide a minimum interior temperature of 68⁰F. If the interior temperature is below 64⁰F, the inspector will record a deficiency for the permanent heat source with a required repair time of 24 hours. Both tenant and landlord will be notified of the 24-hour repair requirement at the completion of the inspection and a follow-up inspection will be automatically scheduled for the following day. Should the interior temperature measure between 64⁰F and 67.9⁰F, the inspector will record a deficiency for the permanent heat source with a required repair timeframe of 30 days, with the follow-up inspection to occur at that time. Building common area (halls, stairways, laundry facilities, lobbies, etc.) without service of a functioning permanent heat source will result in the inspector recording a deficiency with a required repair timeframe of 30 days.

For those residential units and buildings equipped with fire sprinkler systems, it is important to note that visual inspections of the sprinklers will take place with NSPIRE. Sprinkler assemblies cannot be encased or obstructed by and item or object within 18” of the sprinkler head, cannot be damaged, inoperable, or missing (if evidence of previous installation), cannot have evidence of corrosion, and cannot have foreign material (such as dust, paint, etc.) covering 75% or more of the assembly or of the glass bulb. Any of the above will result in the inspector recording a deficiency for the affected sprinkler with a 24-hour repair timeframe. This 24-hour repair requirement is the same regardless of whether the sprinkler is located inside the occupied unit or outside the unit but inside the building which contains the residential unit.

Fire-labeled doors will be inspected with NSPIRE and any of the following issues will result in a recorded deficiency requiring repair within 24 hours: Cannot be missing (if evidence of previous installation), must open, close, and latch properly, self-closing hardware (if applicable) must work as designed, seal or gasket cannot be damaged or missing, cannot have a hole of any size, cannot be damaged in such way that the door integrity is compromised, cannot be propped open nor can it have a toe-kick stop attached, when installed as a residential unit’s entry or passage door it must be able to be designed to be, and able to be, secured by at least one installed lock. Fire doors with damage may have the damage repaired, but the work must have documentation that it was performed in accordance with the manufacturer’s requirements for fire-door repair.

Call-for-aid system (if installed) deficiencies will require repair within 24 hours. Inspectors will check to ensure call-for-aid systems are not blocked, pull cords are no higher than 6” off the floor, pull cords are not tied up or missing, and that they emit sound or light or send a signal to an annunciator. For those systems that send a signal to an annunciator, inspectors will verify the annunciator indicates the correct corresponding room for the signal.

The final NSPIRE standards may be viewed in entirety at NSPIRE Standards | HUD.gov / U.S. Department of Housing and Urban Development (HUD). Owners, landlords, and tenants are encouraged to review the NSPIRE inspection checklist, available at NSPIRE HCV Form_29SEP23.xlsx (hud.gov) as reference during their inspection preparations.

Please note, The PBCA is aware that REAC recently distributed an e-mail delaying implementation deadline for HUD’s Housing Choice Voucher program and stated a new Federal Register Notice will be released shortly. The PBCA is monitoring this information and will update accordingly if this impacts the PBCA implementation date.

-

- The Benchmarking Initiative: A Component of the Green and Resilient Retrofit Program (GRRP)

-

Several years ago, HUD introduced the Green and Resilient Retrofit Program (GRRP). This program provides funding for direct loans and grants to fund projects that improve energy or water efficiency, implement the use of zero-emission electricity generation, enhance indoor air quality or sustainability, or addressing climate resilience of eligible HUD-assisted multifamily projects.

Part of the GRRP program provides funding to support benchmarking at assisted properties. So far more than 700 properties have signed up for HUD’s Multifamily Benchmarking Initiative. This initiative has provided no-cost energy and water benchmarking services to eligible HUD-assisted properties. The President’s Inflation Reduction Act has provided more than $40 million in funding to support efforts to lower energy costs while promoting climate resiliency, preservation, and sustainability in the nation’s housing supply. HUD encourages Multifamily project owners to sign up now so that properties can receive many more years of free benchmarking.

To get started, visit https://www.hud.gov/GRRP/Benchmarking or send your property information to mfbenchmarking@hud.gov.

-

- Wind or Storm Insurance Coverage - Maximum Insurance Deductible

-

On April 17, 2024, HUD issued Notice H 2024-6 to address the challenges that borrowers are facing in the insurance market, caused primarily by weather conditions due to climate change. This Housing Notice increases the maximum casualty insurance deductible amount for wind or named storm coverage. This Notice applies to new mortgage insurance transactions that have not achieved final endorsement.

Wind or named storm deductibles are often much higher than HUD’s maximum deductible of $250,000, requiring borrowers to purchase deductible “buy down” coverage to meet HUD requirements. The costs associated with “buy down” coverage is detrimental for affordable projects with restricted rents that are unable to be increased to cover unexpected operating costs.

Given the realities of climate change and the increasing likelihood of stronger, catastrophic storms, and the assumption that insurers will continue to increase premiums (and deductibles) to offset their cost of insuring properties in certain areas, HUD must adjust to the changing market to remain competitive. HUD also recognizes obvious risks in increasing the wind or named storm deductible higher than the maximum amount currently published in the MAP guide.

HUD proposes to increase the maximum wind or named storm deductible to the greater of $50,000 or 5% of the insurable value per location, up to a maximum amount of $475,000 per occurrence. This policy does not change the general requirement to acquire and maintain general casualty insurance with the current deductible requirements found in the MAP Guide.

Section 3.9.2.4.A.3 of the MAP Guide1 is amended as follows:

3: Limitations of Borrower’s obligation to share cost of damages. HUD’s minimum coverage requirements protect Borrowers by limiting their obligation to share the costs of damages when a casualty occurs and by assuring that the insurance proceeds are sufficient to pay the commensurate portion of the principal amount of any insured mortgage(s) when a damaged building cannot be restored. Typically, insurers require Borrowers to share the cost of damages by one (or both) of two methods: deductibles, and co-insurance requirements. HUD limits Borrowers’ exposure as follows:

a. Casualty insurance deductibles may not exceed the greater of $50,000 or 1% of the insurable value for any particular building up to a maximum amount of $250,000.

b. Separate wind or named storm coverage deductibles may not exceed the greater of $50,000 or 5% of the insurable value per location, up to a maximum amount of $475,000 per occurrence.

i. The Regional Director may waive the wind or named storm deductible, on a case-by-case basis, in excess of 5%, but not to exceed $1,000,000 if it is determined the key principals have the financial strength and level of HUD multifamily experience such that significant repairs from storm damage are achievable despite the higher deductible.

ii. Any request for a deductible waiver in excess of $1,000,000 must be approved by the Director, Office of Multifamily Production headquarters.

HUD will continue to assess whether this change is achieving its policy objectives. HUD reserve the right to further modify this policy in response to the findings of this assessment. Read Notice H 2024- 06 in its entirety for more information.

-

- Member Spotlight: CCS - Andrew Thomas

-

What is your position with CGI?

I process housing projects’ monthly assistance vouchers and paperwork so that they can receive subsidy payments from the Department of Housing and Urban Development, which enables low-income tenants to obtain affordable housing.

How long have you been with CGI?

I was hired in March of this year as a Central Contract Specialist working out of the CGI Federal office in Walnut Creek, CA.

What was your background prior to working with CGI?

Prior to working at CGI, I’ve primarily worked for nonprofit organizations. My last job, which I was at for almost ten years, was as a Quality and Eligibility Specialist. I provided quality assurance across two departments and investigated and verified other nonprofit organizations that were applying for discounted technology for major corporations, such as Microsoft, Intuit, Adobe, etc.

What are your hobbies? Things that you enjoy doing outside of the office?

I’m an avid reader and love riding my bike around the Bay Area when I get the chance, but most of my hobbies fit under the category of “making stuff”. In the past I’ve made everything from beer to soap, and recently I took up woodworking after my wife and I moved into our first house. I’m most proud of our dining room table (which is inspired by Norse designs per my wife’s request) and a pretty comfy rocking chair that hasn’t fallen apart yet.

What brings you the most satisfaction in your day to day tasks?

I find the investigative nature of my work to be the most satisfying thing about it. It can be very engrossing to search out and put together disparate pieces of information to figure out exactly what’s needed to make everything work. There are a lot of similarities between this job and my last one, so I’m glad I get to keep using that skillset!

What is the best piece of advice that you can provide to an Owner/Agent?

My advice to owner/agents: make sure to take the time to fully read and follow all instructions, especially the “take the time” part. It can be tempting to rush along with deadlines looming and other tasks clamoring for attention, but it’s usually better to lose a little time upfront to make sure everything is right than to rush things and make mistakes which can take days to fix.

- Contact Center Poster/Information

-

ALL RESIDENTS OF H.U.D. SUBSIDIZED PROPERTIES

(Click here for a printable .pdf English version) (Click here for a printable .pdf Spanish version)

California Affordable Housing Initiatives (CAHI) is the HUD Contract Administrator and is responsible for responding to resident concerns. CAHI Call Center has a team of Customer Relation Specialist (CRS) that will receive, investigate and document concerns such as, but not limited to the following:- Questions or concerns regarding work order follow-up.

- Questions regarding the calculation of your rent.

- Address health & safety and HUD Handbook 4350.3 concerns.

Call Center Purpose:

- Call Center aids in ensuring HUDs mission of providing Decent, Safe and Sanitary Housing.

- Serve as a neutral third party to residents, owners and the public.

- Assist with clarifying HUD Occupancy Handbook 4350.3 requirements.

Call Center Contact Information and Business Hours:

- Hours of Operation: Monday-Friday, 8:00am to 5:00pm

- Contact Numbers: 800-982-5221 fax: 614-985-1502 (leave message after hours)

- Written Summaries: 107 South High Street, 2nd Floor, Columbus, Ohio 43215

- Email: PBCAContactCenter@cgifederal.com

- Website: www.cahi-oakland.org

àTo access the CAHI website scan this QR code with your smartphone

Concerns can be submitted by the following:

- Phone

- Fax

- Voicemail

- FOIA- Freedom of Information Act request must be submitted directly to HUD

Required Information to open an inquiry:

- Property name

- Caller’s name (anonymous calls accepted)

- Caller’s telephone number with area code

- Caller’s address including apartment number

- A brief, detailed description of the caller’s concern(s)

EQUAL HOUSING OPPORTUNITY

1550 Parkside Drive • Suite 150 • Walnut Creek, CA • 94596

Tel: 800-982-5221 • English TTY: 800-735-2929 • Spanish TTY: 800-855-3000 • PBCA@cahi-oakland.org

- Closing Thoughts

-

If you are not already receiving this publication via e-mail, or if you have ideas, suggestions, or questions for future publications, we’d like to hear from you. Please send an email to andrew.hill@cgifederal.com